Sep 14

Parenting Corner – Teaching Children About Money

Q: How do I teach my kids to be responsible with money when we live in a “keeping up with the Jones’s” society?

A: Great Question! Since many of today’s adults were taught it’s inappropriate to talk about money, the conversations most kids hear on the subject revolve around paying bills and financial stress. The reality is your kids are listening to your language about money and they are watching how you spend, save and invest it. Remember money is neutral – the story you tell yourself and your kids about money is what gives it meaning.

It’s important to start talking about money as early as possible – depending on the child the conversation can happen as young as 5 and should be before they are 10. Since you want to begin at their point of understanding, ask them “where do you think money comes from?” Their answer will give you a good place to start and will allow you to direct the conversation to how money is earned. The next step is to create opportunities for your kids to earn money; it gives them a sense of accomplishment and a value for money. (NOTE: I do not give my kids allowance or pay them for chores – we are a family and they are expected to help around the house. They are paid for “above and beyond” tasks like vacuuming and washing my car, emptying, washing and reorganizing cabinets, organizing and cleaning the garage, etc.)

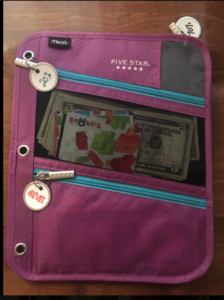

Since money is only good for the good it can do, once your kids have earned some money you have the chance to show them all the good money can do. My kids use a 3 pocket pencil case. The top pocket is for Spending – 20%, the bottom pocket is for Giving – 10% and the largest pocket in the back is for Saving – 70%. (As the kids have gotten older the money in the Save pocket has been split into two piles – Saving and Investing.) They divide all the money they receive – gifts and money earned – into these categories which has also served a great tool for them to practice their math skills.

Being responsible for earning and tracking their money gives them a sense of pride. We have conversations about when and how much they spend, and they choose where to donate. Approximately four times a year they bring their Savings to the bank to watch it grow.

You will influence your kid’s beliefs about money; you can show them they need to “keep up with the Jones’s”, or let them develop a scarcity mindset…or with positive direction from you, they can create their own story of abundance.

Laura Treonze, serves as Chief Life Strategist with LMT Consulting, which helps executives and teams create massive success through self-awareness. Her life-changing approach has transformed individuals and families and has redefined the way non-profits and corporations “do” business.

Laura Treonze, serves as Chief Life Strategist with LMT Consulting, which helps executives and teams create massive success through self-awareness. Her life-changing approach has transformed individuals and families and has redefined the way non-profits and corporations “do” business.